This website and book provide general information only and do not constitute personal financial advice.

This website uses cookies to ensure you get the best experience on our website. Privacy Policy Cookie Policy

You could retire on paper. So why does it still feel like such a big decision?

For many people in their 50s and 60s, the problem isn’t a lack of pensions or spreadsheets – it’s a lack of clarity and confidence.

You might have several retirement accounts, some savings and a rough idea of “your number”, but still find yourself asking:

- Am I really ready to retire – or should I wait?

- What if I stop too early and regret it?

- What if I leave it too late and miss my best years?

If retirement feels unclear, this book gives you a calm framework to make a confident decision.

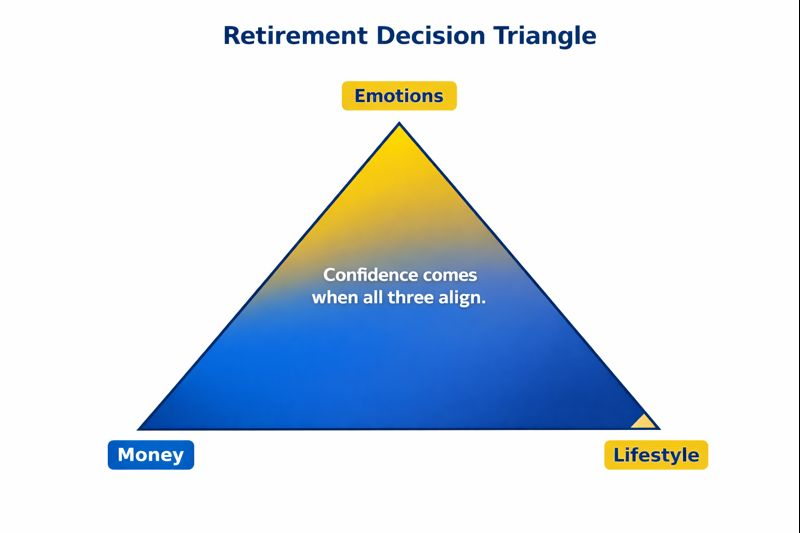

In Retirement: It’s Personal, author Richard Cakans shows you how to decide when to retire by aligning three things that must work together:

- Money – what you have, what you need, and how to turn pensions and investments into a sustainable income

- Emotions – fears about running out of money or time, guilt about stopping work, and the deeper questions behind “Am I ready?”

- Lifestyle – what you actually want your days, weeks and years to look like in this next chapter

Benefits / outcomes

Drawing on years of real conversations with people approaching retirement, the book helps you:

-

Understand what “enough” looks like for you

-

Make sense of retirement income choices in plain English

-

Use tools like “The Lottery Question” and the three phases of retirement to clarify your thinking

-

Build a simple, flexible plan you can review each year

If you’re unsure whether to retire, reduce your hours or just keep going, this book will help you move from anxious guesswork to informed, confident decisions about the rest of your life.

THE BOOK IS LAUNCHED IN

Are your Money, Emotions and Lifestyle Aligned ? Sign up below to the newsletter

Thank you for subscribing!

I’m Richard Cakans, I wrote Retirement: It's Personal to help people approaching retirement make clearer decisions by aligning money, emotions and lifestyle — so retirement feels right on paper and in real life.